Summary

Most large stock markets in the world have been supported by Central Banks since the GFC.

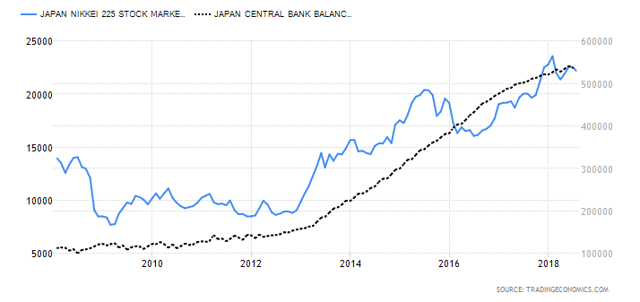

There is a direct correlation between rising Central Bank balances and rising asset markets that investors can use to their advantage.

Central Bank balances are a useful tool for trading movements in the stock market index in advance. Most stock markets lag the Central Bank balance by six to twelve months.

The G20 Central Bankers and finance ministers met in Argentina over the last weekend, and one of the topics for discussion would have been the impact of their actions on markets and the need to buy.

The purpose of this article is to graphically show and describe how the central banks (CB) of most countries have been supporting asset prices with their balance sheets.

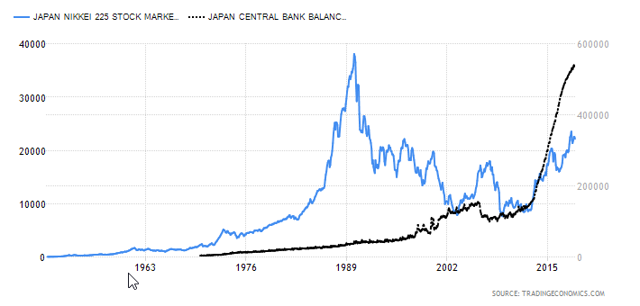

The central bank with the most experience in supporting markets is the Central Bank of Japan (BOJ). The chart below shows the long- and near-term efforts of the Japanese Central Bankers.

As can be seen on the chart above, Japan had a financial crisis in the early 1990s, similar to but much larger than the Savings and Loans crisis that occurred in the USA at the same time.

It took the BOJ a long time to step into the market; it let the markets slide for another ten years before reacting.

Making up for lost time, the BOJ has accelerated its efforts since the GFC, as can be seen in the chart below, with a strong correlation between the CB bank balance and the stock market direction.

Comments

Post a Comment