Alipay, the biggest payment application in China valued at $150 billion, officially banned over-the-counter (OTC) Bitcoin trading, prohibiting traders from utilizing Alipay accounts to initiate digital asset trades.

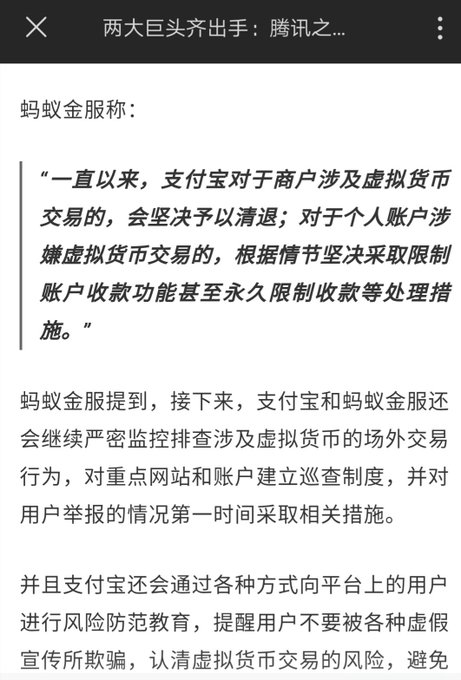

The announcement of Alipay shared by Red Li, a cryptocurrency researcher and the co-founder of Chinese cryptocurrency community 8BTC, explicitly stated that users of Alipay are not allowed to use the financial network to trade Bitcoin in OTC and unregulated markets.

Why is Alipay Banning OTC Trades?

Ant Financial, a subsidiary of Alibaba, is the parent company of Alipay. Its valuation increased to $150 billion earlier 2018, after securing a massive $10 billion funding round.

The conglomerate was able to raise a gargantuan funding round primarily due to the success and exponential growth rate of Alipay, its core business. The $10 billion was brought in as additional capital to fund the aggressive expansion of the Alipay fintech network globally outside of China.

But, to understand the decision of Alipay to ban OTC Bitcoin trades, it is necessary to acknowledge the way Alipay has dominated the Chinese payment market, garnering 90 percent of the market share.

Throughout the past decade, the Chinese government has focused on providing local companies and service provides absolute dominance over the local market. The government eliminated competition like Google, Twitter, and Facebook, replacing them with Baidu, WeChat, and others.

While the Chinese government recently permitted overseas companies to operate within the local market with licenses, due to the funneling strategy used by China, Alipay already reached mass adoption, with over half of the Chinese population already using Alipay and 90 percent of mobile customers using the network as the primary payment method.

For many years, Alipay and Jack Ma, the founder, and chairman of Alibaba, have expressed optimism towards cryptocurrency and blockchain technology.

Even though Ma described Bitcoin to have bubble-like characteristics, Ma emphasized that cryptocurrencies as consensus currencies and blockchain-based distributed systems will achieve massive mainstream adoption in the future.

Despite the enthusiasm towards the cryptocurrency and blockchain sector, Alipay was pressured to eliminate cryptocurrency traders from its network indirectly, when the government of China asked all banks and financial service providers in February to ban Bitcoin trading accounts. An article by Financial News, a publication affiliated to People’s Bank of China (PBOC) reads:

“To prevent financial risks, China will step up measures to remove any onshore or offshore platforms related to virtual currency trading or ICOs,”

It is possible that a large number of traders in China have been trading Bitcoin in a peer-to-peer manner in the OTC and unregulated market, without the authorization of the government. Consequently, Alipay was asked to prevent its financial network from being used to fuel cryptocurrency trades. The Financial News continues:

“ICOs and virtual currency trading did not completely withdraw from China following the official ban … after the closure of the domestic virtual currency exchanges, many people turned to overseas platforms to continue participating in virtual currency transactions.”

The statement of Alibaba shared by Li stated that individual accounts should not be used in trading Bitcoin in unregulated markets and any sign of trading will lead to the shutdown of the account.

What Happens in the Near Future?

Bitcoin trading and digital asset exchanges were banned by the Chinese government in September in 2017, and the stance of the government regarding the cryptocurrency exchange market has not changed since then.

The prohibition of Bitcoin trading by Alipay solidified the viewpoint of China towards digital asset trading, which is banned as a part of a larger initiative to strengthen capital controls.

Bitcoin, currently ranked #1 by market cap, is up 1.7% over the past 24 hours. BTC has a market cap of $112.88B with a 24 hour volume of $3.56B.

Chart by CryptoCompare

Bitcoin is up 1.7% over the past 24 hours.

Cover Photo by Chuttersnap on Unsplash

Comments

Post a Comment